While Samsung Electronics is reeling from a patent pounding by its smartphone rival Apple Inc, this is unlikely to damage the other part of their relationship where Samsung is the sole supplier of Apple designed chips that power the iPhone and iPad.

While Samsung Electronics is reeling from a patent pounding by its smartphone rival Apple Inc, this is unlikely to damage the other part of their relationship where Samsung is the sole supplier of Apple designed chips that power the iPhone and iPad.

At an emergency meeting in Seoul early on Sunday following the damning U.S. legal defeat, the South Korean group's post mortem was led by vice chairman Choi Gee-sung and the head of the mobile business JK Shin, rather than by CEO Kwon Oh-hyun, whose primary role is in charge of the components business.

The clear message from Samsung is that a strict internal firewall between its handset business and its components operations remains intact.

While it plans to appeal the U.S. verdict, and a damages bill for $1.05 billion for copying critical features of Apple's popular mobile devices a sum that could be trebled Samsung will not want to put at risk its Apple supply contract which is worth billions of dollars.

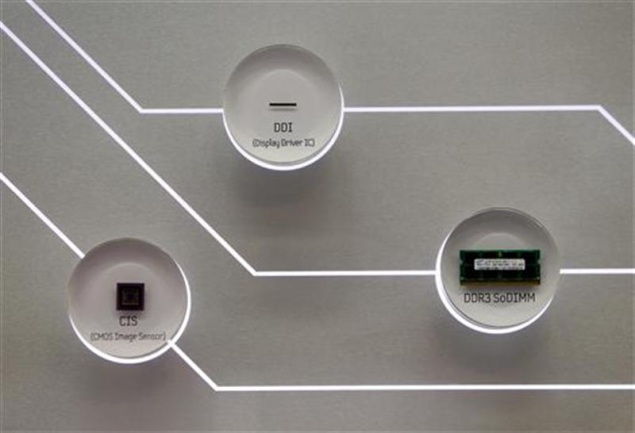

As well as being the only supplier of micro processors for the iPhone and iPad, Samsung also supplies DRAM and NAND-type memory chips and flat screens used in the popular Apple gadgets. Samsung products comprise 26 percent of the component cost of the iPhone, Samsung's lead counsel Charles Verhoeven was quoted as saying in the media.

Samsung's component sales could hit $13 billion next year and bring in $2.2 billion in operating profit, according to a recent estimate by Morgan Stanley. That's nearly 8 percent of estimated group operating profit for next year.

Too important

Experts and analysts said the symbiotic business relationship between Samsung and Apple is too important for either to put at risk.

Experts and analysts said the symbiotic business relationship between Samsung and Apple is too important for either to put at risk.

"Apple needs Samsung to make the iPhone and iPad. Period. Samsung is the sole supplier of Apple's processing chips and without Samsung, they can't make these products," said James Song, an analyst at KDB Daewoo Securities in Seoul. "Samsung might be considering lots of options to leverage its components business' importance and pressure Apple, and Apple could be also well aware of this."

With that in mind, Samsung had sought to resolve the patent dispute with Apple which Apple first brought up shortly after Samsung launched its first Galaxy model in 2010 through negotiation rather than in the courtroom.

"We initially proposed to negotiate with Apple instead of going to court, as they had been one of our most important customers," Samsung said in an internal memo sent to employees and released to the media on Monday. "However, Apple pressed on with a lawsuit, and we have had little choice but to counter sue."

While Samsung has been found to have copied innovative features of the iPhone and iPad, the Korean group's lawyers have emphasized that its own innovative components and wireless technology patents, which the U.S. jury ruled that Apple did not violate, made Apple's products a reality.

"Apple isn't that stupid (to risk its Samsung parts deal). Apple's agreements with Samsung will ensure that Samsung has no choice but to comply and supply," Florian Mueller, an intellectual property consultant, posted on his blog.

"Also, Samsung's other customers would lose faith if it turned out unreliable. And since Apple threatened Samsung with litigation two years ago, it's had plenty of time to identify alternatives."

Sharp sell off

Samsung itself shrugged off market concerns that its component contracts were at risk due to the litigation. Samsung shares tumbled more than 7 percent on Monday, wiping $12 billion off its market value.

Samsung itself shrugged off market concerns that its component contracts were at risk due to the litigation. Samsung shares tumbled more than 7 percent on Monday, wiping $12 billion off its market value.

"(The) supply contract remains a separate issue from the litigation and there'll be no change to it going forward," said an executive who took part in Sunday's meeting, which was not attended Jay Y. Lee, chief operating offer and heir apparent to Samsung Chairman Lee Kun-hee, according to the executive.

Kwon was promoted to CEO in June, with JK Shin and BK Yoon leading the telecommunications and consumer electronics divisions respectively so as to avoid potential conflicts of interest, as Samsung supplies parts to its main rivals such as Apple, Nokia , HTC Corp and Sony Corp.

As demand for mobile gadgets has soared, Samsung announced just last week a $4 billion investment to boost output at its U.S. chip plant, where it makes chips for the iPhone and iPad. That comes on top of $2 billion of spending Samsung unveiled two months ago to build a new chip plant and the conversion of existing chip lines to make logic chips to power mobile gadgets.

Supply chain

Apple has been looking to spread its supply chain to reduce its reliance on Samsung. The U.S. firm frequently faces a supply crunch when a new product is launched, triggering a consumer stampede that drives demand far in excess of supply and production capability.

Apple has been looking to spread its supply chain to reduce its reliance on Samsung. The U.S. firm frequently faces a supply crunch when a new product is launched, triggering a consumer stampede that drives demand far in excess of supply and production capability.

Earlier this year, a source told Reuters that Japan's Elpida Memory Inc was selling more than half of its mobile DRAM chips to Apple.

Samsung mainly competes with Toshiba Corp and Korean rival SK Hynix in supplying memory chips for Apple, and LG Display in flat-screen panels.

Samsung has around 70 percent global market share in mobile DRAMs, but Apple sources only 40 percent of its mobile DRAM chip requirement from Samsung, a boon to the likes of Elpida and SK Hynix, analysts say.

Shares in LG Display, which is widely speculated to supply a new and thinner panel for the next iPhone, jumped more than 4 percent on Monday. SK Hynix slipped 0.5 percent in a flat market.

"For its part, Samsung is also diversifying its customer base to reduce its reliance to Apple adding new ones like Qualcomm, and that'll prove to be a good strategy longer term as Apple component margins are generally low due to its huge bargaining power," said Daewoo's Song.

"Other suppliers may benefit from a worsening Apple/Samsung relationship in the short term, but in terms of margins, I'm doubtful they can make good money from any Apple cookie crumbs that Samsung throws away."

Copyright Thomson Reuters 2012

No comments:

Post a Comment